101 guide - Your Salary components and calculations

Understanding salary components might just be the worst thing about salaries (apart from taxes, of course). There's usually the confusion of understanding what bracket how much of your money falls into, or the panicky calculations of your in-hand paycheck when you get an offer. Let's solve this by taking a step-by-step look at salary components.

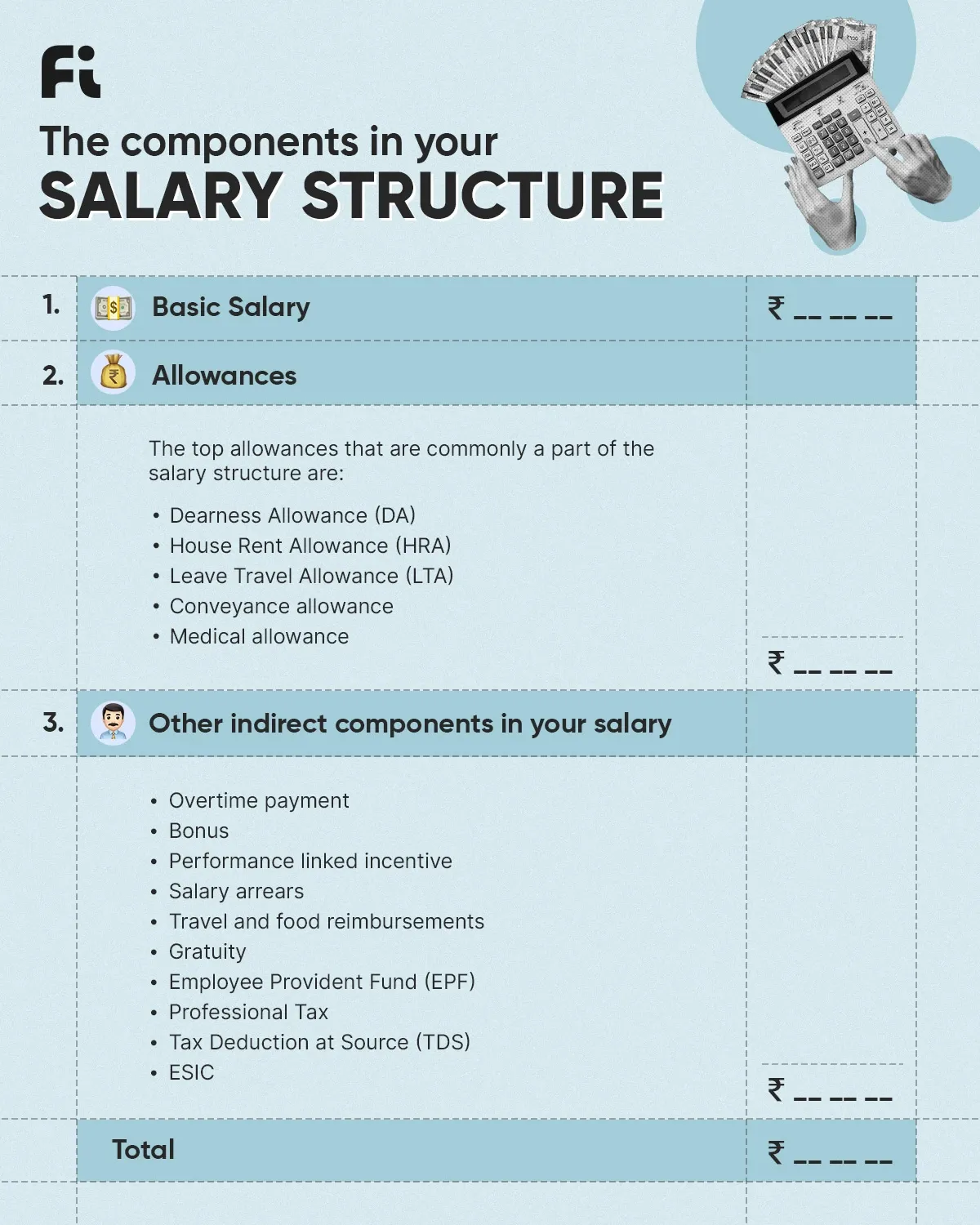

The typical salary structure in India consists of both direct and indirect components. Some of these may be fixed, while others may be variable components of your salary.

Allowances are extra payments to employees on top of their basic salary. They are given to help cover the costs of employment. Allowances may be taxable, depending on the Income Tax Act, 1961. Not all employers offer allowances, and the type of allowance offered depends on the employer's policy, job nature, workplace location, and other factors.

Employers offer Dearness Allowance (DA) to help employees combat inflation. DA is a percentage of the basic salary, for example, 20% of a monthly basic salary of ₹1 lakh would result in ₹20,000 of DA. Only public sector employees in India typically receive DA. Private sector employees do not receive DA. It is important to note that DA is fully taxable.

HRA compensates rental expenses. It may not be fully taxable. You may be eligible for deduction as per Income Tax Act, 1961. Deduction is the least of the following —

Employers offer an allowance for domestic travel expenses during employee holidays. The Leave Travel Allowance (LTA) is only paid for actual trips taken by the employee or their dependent family. LTA is a common salary component in both the private and public sectors, and is tax-exempt up to the actual travel costs.

The conveyance allowance is ₹1,600 per month or ₹19,200 per annum and is exempt from tax.

The medical allowance compensates employees for medical costs and is fixed by the employer. It is exempt from tax up to ₹15,000 per year.

In addition to the discussed allowances, your pay slip may include other indirect components such as:

Employees receive a bonus for completing additional office work outside normal working hours.

This refers to a fixed sum of money that is paid out to employees after they complete a year of service at the company.

Incentives are paid to employees as a bonus for their outstanding performance, with the amount linked to their results.

Arrears are payments made to employees in case of retroactive salary revisions, reflecting what should have been paid if the revision had occurred earlier.

The corporation reimburses expenses for business travel and meetings.

Gratuity is a lump sum payment made to employees leaving the company after 5 years of service. It is fully exempt from tax if received due to retirement, superannuation, or termination.

We previously discussed employee allowances and benefits, and now we will discuss the most common deductions in India's salary structure.

If you work for an organization with 20 or more employees, you must contribute to the Employee Provident Fund (EPF). Your EPF account receives regular monthly contributions, including 12% of your basic salary and dearness allowance as your contribution and an equal amount as your employer's contribution.

The Employee Provident Fund primarily aims to provide financial security to private and public sector employees after retirement by saving a substantial amount in their EPF account.

The professional tax is state-specific and varies depending on your workplace's location, but it is limited to ₹2,500 annually across India.

TDS, or tax deducted at source, is a portion of your income tax. Employers typically subtract TDS from the monthly income paid to their employees to reduce the year-end tax burden and meet advance tax obligations.

The TDS rate is usually 10%, but additional taxes may be required if your tax liability is higher. If your tax liability is lower, you can file for a refund.

ESIC is an insurance that is not mandatory for all employees. It is only applicable to employees whose gross salary is not more than ₹21,000. Companies with 10 or more employees in this salary bracket are expected to deduct ESIC.

In this context, we have three key metrics that you should be aware of —

Your gross salary is calculated by adding together your basic salary and various allowances, before any deductions are made. Use the formula below to find your gross salary:

Gross Salary = Basic Salary + DA + HRA + Other Allowances

Your net salary is the amount transferred to your bank account each month after deducting taxes and other expenses from your gross salary. To calculate your net salary, subtract all deductions such as income tax, professional tax, and Employer’s Provident Fund from your gross salary.

The CTC is the total cost of an employee to a company, including salary, and other indirect benefits. Companies use this metric as a benchmark when hiring new employees. The formula to calculate CTC is:CTC = Gross Salary + PF + Gratuity + Other Indirect Benefits

Understanding salary components is crucial for employees to make informed decisions. A salary structure consists of direct and indirect components, such as basic salary, allowances, and other benefits. The gross salary is the sum of all components, while the net salary is the amount received after tax deductions.

The CTC includes all indirect benefits and components, such as basic salary, PF, gratuity, and allowances. It's important to grasp the tax implications of different components and deductions to manage finances effectively. Employers must communicate the salary structure clearly, and employees should ask questions if confused. By understanding salary components, employees can make informed decisions, negotiate better salaries, and plan finances effectively.

Fi, partnered with Federal Bank, offers a salary account with benefits such as:

To divide a salary package, understand the components of the salary structure.

The components included in gross salary are basic salary, dearness allowance (DA), house rent allowance (HRA), and other allowances.

CTC doesn't cover TDS. TDS, which is Tax Deducted at Source, is deducted from the employee's salary at the time of payment. TDS is typically 10% of the salary and has no threshold limit.

PF is not included in your fixed salary but is typically included in your basic salary. Your fixed salary includes Dearness Allowance, HRA, and other allowances.