When you think of the many credit card uses available today, you may recall that they can be used to buy and pay for things later. But while this may be the primary credit card use, it offers other benefits. Today, credit cards have evolved beyond mere special or EMI payment solutions and moved to a daily use tool.

Let's dive deep into the different types, perks and uses of credit cards, how to maximise them and which is the best credit card for daily use. These can be divided into 4 parts: for bill payments, frequent shoppers, building a credit score, and emergencies.

The most common use of credit cards is bill payments. Credit cards offer a convenient way to pay bills online or offline. You can make purchases and defer payments during the interest-free credit period, typically 20 to 55 days. However, to maintain the interest-free status, ensure no outstanding dues and avoid cash withdrawals.

Timely payment of your credit card bill is crucial to building a credit score and avoiding high-interest charges, which can reach up to 48% per annum as of May 2023.

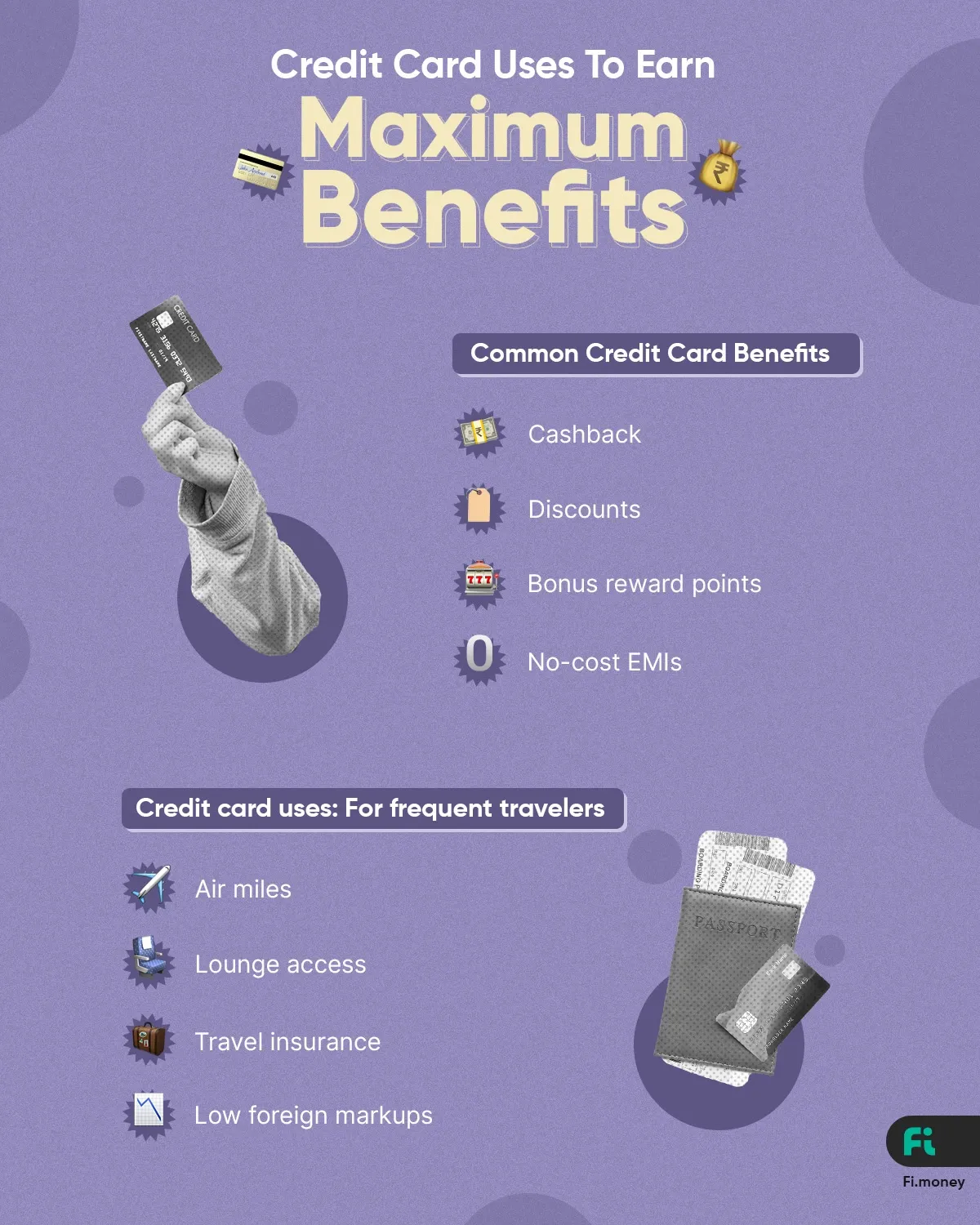

If you are a frequent shopper, credit cards have many benefits and perks that you can take advantage of. Some standard features you can benefit from include cashback, discounts, bonus reward points and even no-cost EMIs.

Here, a portion of the amount spent is returned to the spender as cashback. Usually, it is a percentage of the amount spent on select, eligible purchases. If you shop frequently using your credit card, this is a feature that you can take advantage of.

Most shopping credit cards offer discounts on various lifestyle products or services. Shoppers can make use of credit card discounts to spend less on preferred products or services. Before applying for a card, check its benefits and look for any seasonal or additional discounts.

In many shopping credit cards, you may also be entitled to receive additional bonus reward points if you shop beyond a particular threshold limit. Keep an eye on these benefits to accumulate more reward points on your card, which you can redeem for various products and services.

Lastly, a few credit cards also allow you to convert some of your shopping costs into no-cost EMIs so that you can repay the purchase cost conveniently over a tenure of your choice without any added interest.

If you travel frequently for work or pleasure, you can benefit from the many uses of credit cards. Most notably, many travel-friendly credit cards have the following perks for frequent travellers.

Air miles are essential reward points that you can redeem for free flight tickets or hotel bookings. Choose credit cards that offer these rewards if you travel a lot. Did you know that the Fi-Federal co-branded Credit Card will soon offer a chance for users to convert their Fi-Coins into Air Miles?

Many travel-friendly credit cards also give you a set number of complimentary access to domestic and/or international airport lounges.

Travel insurance is another benefit that these credit cards offer. The comprehensive cover usually includes trip delays, cancellations, loss of luggage and death or disability.

You may also make use of credit cards to make payments abroad. Here, cards with low foreign markups can be ideal since you will not incur high conversion costs. FYI: FOREX markup on the Fi-Federal co-branded Credit Card is as low as 1%.

Your credit card can also help you build a good credit history and improve your credit score. Want to know how to use a credit card to boost your credit history? To do this, it is crucial to repay your credit card bills on time. When you do this, your credit card issuer passes on this information to credit information companies like CIBIL and Equifax.

These companies then consider your repayment history and adjust your credit score accordingly. A solid track record of prompt payments will boost your score. It makes it easier for you to access other credit facilities later in life if you need to.

Credit cards can also be handy if you need emergency cash for urgent bills. You can use credit cards to withdraw money from an ATM. Alternatively, you can add your credit card as a payment method in your UPI app and handle emergency financial needs.

Knowing how to use credit cards optimally can help you tap into its full potential. And you now know how to make the most of the many credit card uses and maximise the benefits these cards offer. Consider these pointers if you already have a few or plan to apply for the best credit card for daily use.

Your search for the 'best credit card for daily use' ends now. Introducing the Fi-Federal co-branded Credit Card, where you can enjoy a value back on your spending. With this card, you'll be rewarded for every single one of your purchases.

Yes, one of the lesser-known uses of a credit card is that it can be used in an ATM to withdraw cash. You can use it just like a debit card to get some cash in hand for emergency purposes. However, remember that cash withdrawal charges will apply, and you must repay the amount withdrawn within the due date. So it's therefore not advisable to use your credit card to withdraw cash, except under dire emergencies.

Log into your UPI app and add the credit card as a payment method. You will have to enter the details required, such as the cardholder's name, the credit card number, the expiry date and the CVV. Your credit card will then be added as a payment method, and you can use it to make payments via UPI.

Credit cards have multiple features that make them attractive to users - these can be rewards, high credit limits, flexible payouts, EMIs on credit cards and more.