Why Fi?

100% digital

& secure

2% back* on

UPI spends

0 Forex* International

Debit Card

Instant

Personal Loan**

0 penalty

daily SIPs**

*T&C Apply. Valid on select Fi Plans

**In partnership with regulated entities

**In partnership with regulated entities

IN PARTNERSHIP WITH

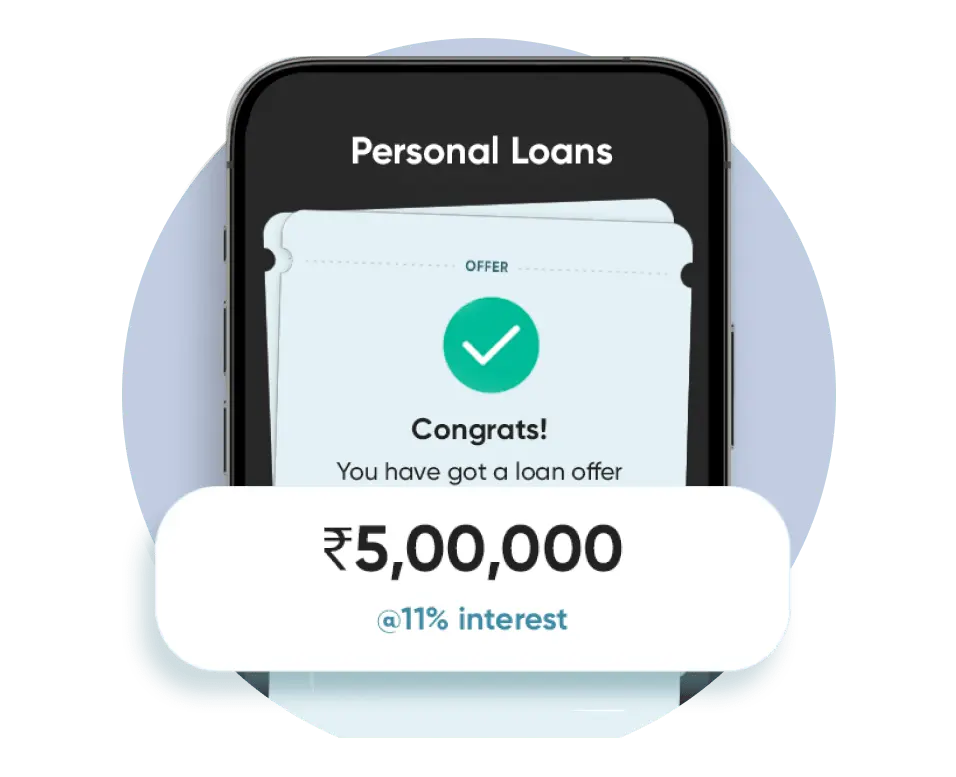

It's 100% digital and takes less than 5 minutes. All you need is your PAN and Aadhaar linked to your phone number. Fi's security checks ensure the safety of your data. Any working professional aged 21 & above can access Fi.

Get a Zero Forex* International

Debit Card

Debit Card

With the Fi-Federal Debit Card, enjoy 0 Forex markup on international spends on select plans. Get rewards on domestic spends as well.

*Valid on select Fi Plans.

Earn upto 3% back* on your UPI spends

Earn up to ₹1000 back as Fi-Points every month. Redeem them for exclusive merchandise, offers, and gift vouchers.

*T&C Apply. Valid on select Fi Plans.

Grow your money with the right investments

Start a Fixed Deposit & earn returns up to 7.2% p.a. You can also start your US Stocks journey with just ₹1,000. Or try to explore Mutual Funds with 0-penalty SIPs. Fi partners with regulated entities to offer these diverse investment options.

Grab the most rewarding

Credit Cards

Credit Cards

Issued by Federal Bank in partnership with Fi Brand Pvt. Ltd.

Get the AmpliFi

Fi-Federal Credit Card

Fi-Federal Credit Card

Earn 3% returns on spends on Top 20+ brands. Enjoy 0 Forex fees & free lounge access. Get welcome vouchers worth ₹4,250 & more rewards on other milestones. Joining fee: ₹2000 +GST

*T&C Apply. Logos are only for illustration purposes.

Get Instant Personal Loans in minutes

POWERED BY

About Fi

Fi was founded in 2019 by Sujith Narayanan and Sumit Gwalani (ex-Google) who built Google Pay in India. The founding team has veterans from Google, Netflix, PayPal, Flipkart and more who came together to change the way Indian Millennials manage their money. Backed by major league investors Sequoia India and Ribbit Capital, Fi Money is based in Bangalore, and operates in over 16,000 pin codes across India.

Fi partners with the best to secure your money

ISO 27001:2022

Our partner bank hosts your Savings Account and follows all security standards per applicable regulations.

Your money is always safe with our banking partner - Federal Bank, is covered under the Deposit Insurance and Credit Guarantee Corporation Scheme. This insures your money up to ₹5 lakh.

Fi itself is not a bank and doesn’t hold or claim to have a banking license.