What is the Best Fire Insurance Plan in India?

The house you bought or the one which took years to build can all be undone in a matter of minutes if a fire took place. Corporate offices and tech parks have routine fire drills to train people how to handle themselves in the event of a fire. Having fire insurance for your building has now become a vital checkpoint when new buildings come up. What does fire insurance provide? Let’s find out.

As the name says, fire insurance is a type of property insurance that covers loss and damage resulting from a fire. In addition to the home insurance, signing up for fire insurance covers the costs of repairing, replacing, or rebuilding structures that may exceed the limit specified by the home insurance. It includes other perils like explosion, implosion, storm, earthquake, etc.

Fire insurance covers all losses resulting from an unintentional fire, subject to the terms and conditions of the fire insurance, which is limited by the policy value rather than the level of damage incurred by the property owner. Losses that are generally covered include:

Initially, insurance companies were allowed to sell customisable fire insurance to customers by either altering the sum assured, the features offered, giving discounts etc. This led to a lot of confusion in the minds of consumers, and many of them were unable to claim the insurance as a result of the above alterations.

Recently, the IRDAI announced changes to fire insurance, clubbing them into three broad categories with minimum room for changes by the insurance providers.

Since the IRDAI has standardised the features of fire insurance, it is highly advised that you purchase fire insurance since the process of understanding what all will be covered is now the same across all companies. Keep the following tips in mind:

It's important to have the appropriate insurance coverage when it comes to fire insurance. It is essential to choose the appropriate insurance because the goal of insurance is to compensate the policyholder in the event of a loss. Make a list of all the things you want to insure in order to make sure you get the right coverage amount. If you are the building owner, you must also buy fire insurance for the building's structure.

While it's important to understand what a fire insurance policy covers, it's just as important to understand what it doesn't. The insurance may deny the claim in certain circumstances. For instance, when a fire breaks out owing to negligence, a war, or other external dangers.

In a similar manner, the fire insurance provider is not responsible for covering the loss or damage if one of its employees is involved in the fire and its spread.

Understand the fire insurance policy's exclusions thoroughly to prevent the circumstance where your insurer might deny your claim.

The insurer would be curious to know what safety measures you have implemented in your place before approving the fire insurance policy. Smoke detectors, fire extinguishers, and other safety measures can assist you in giving lesser premium rates.

You can get a fire insurance plan that is reasonable by carefully comparing the many fire insurance quotes you've received from various property insurance firms.

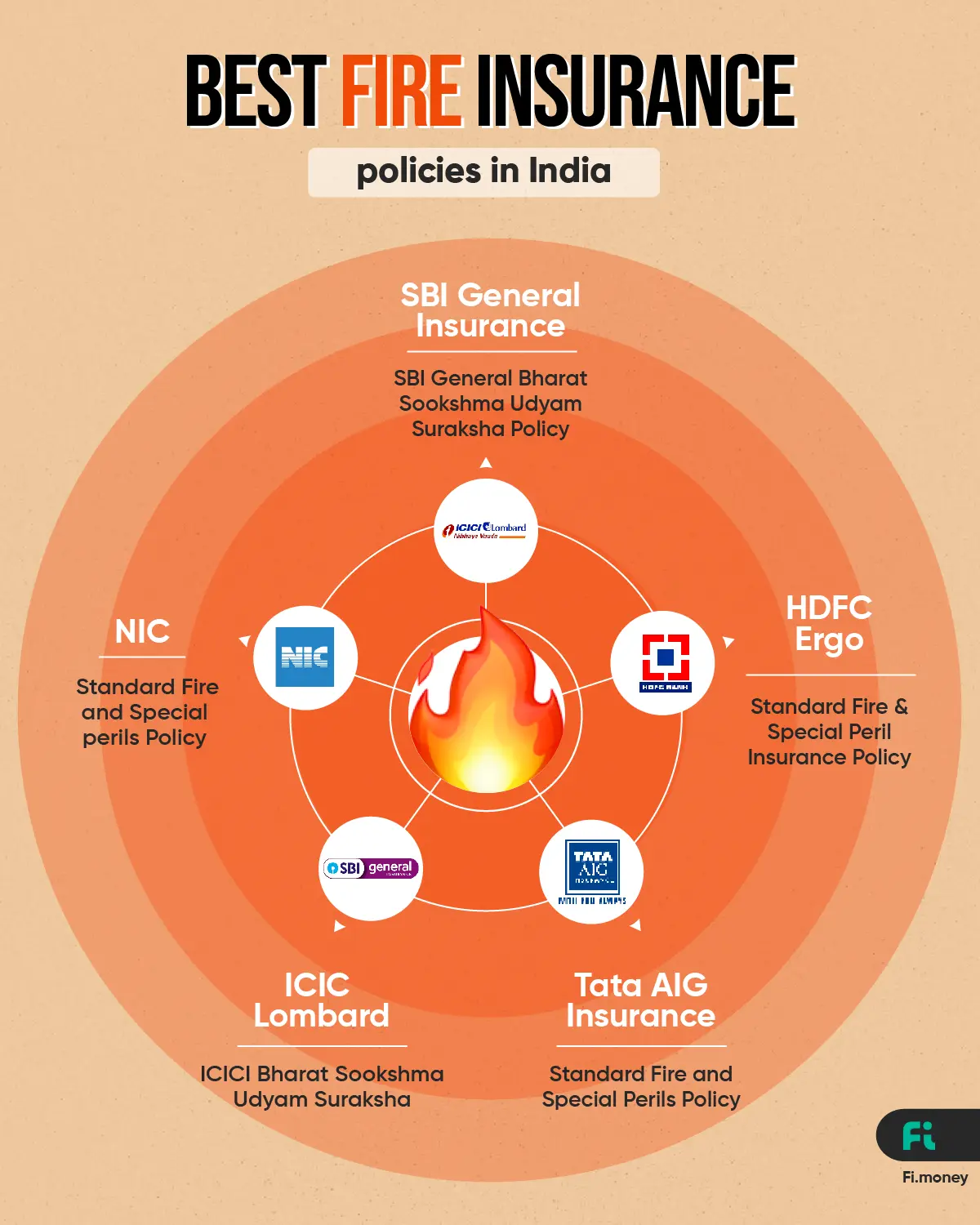

Take a look at some of the best fire insurance plans available in India:

It is difficult to choose one fire insurance company over the rest. India’s insurance regulator, IRDAI, has standardised fire insurance policies to a large extent. Yet there are certain differences in the features that make some policies more attractive based on your specific needs. You should research and compare different fire insurance policies available depending on your requirements to find out the one best for you.

Fire insurance is available in three categories depending on the sum insured. The coverage offered by the Bharat Sookshma Udyam Suraksha is common and offered by the other two policies as well - Bharat Laghu Udyam Suraksha and Standard Fire & Special Perils.

There are many home insurance policies offered by the different insurance companies in India to protect your house from a natural disaster. The best house insurance is subjective and depends on your requirements. Research and compare the various house insurance policies available and select the one best for your specific needs.

The purpose of taking a fire insurance is to protect yourself from financial losses that can come with an unforseen fire. Losses that are generally covered include: