It has become incredibly easy to complete your PAN card corrections online. There's a PAN card correction form which you can download and fill up to get all your corrections done in no time.

How to Get Corrections Done on your PAN Card Online

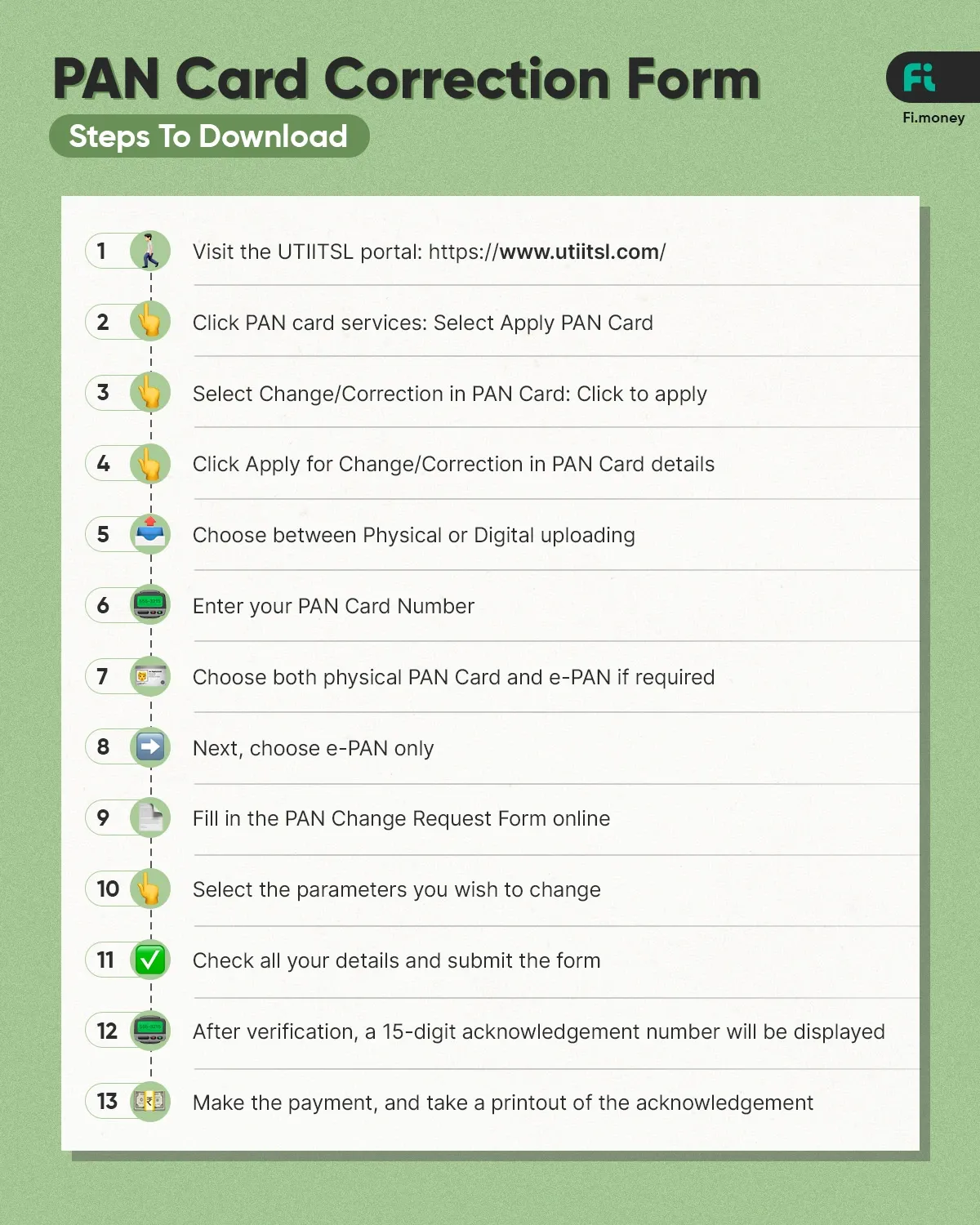

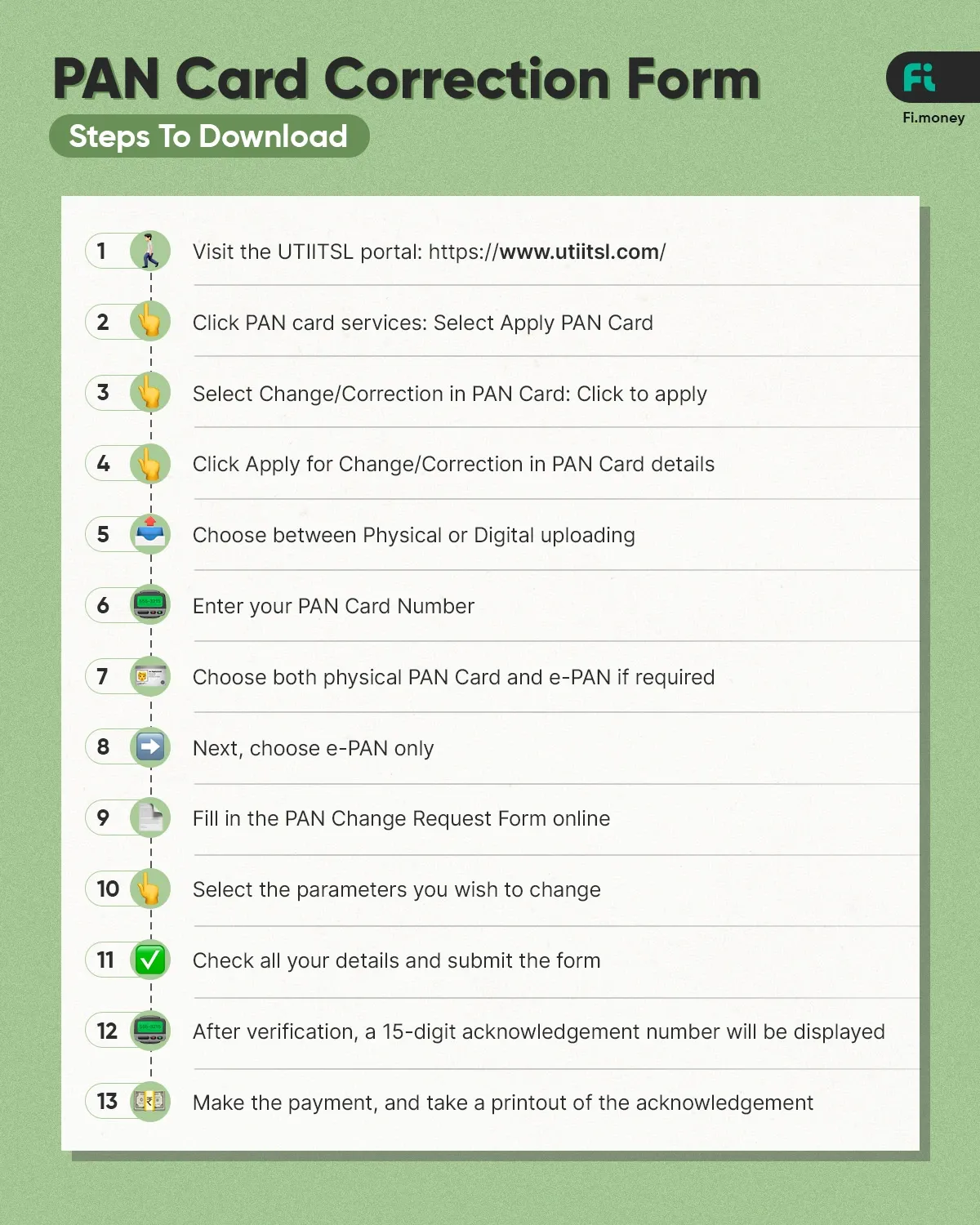

Follow these steps to reach the PAN card change form and make changes to your PAN card.

1. Through UTIITSL (UTI Infrastructure Technology And Services Limited)

-

Visit the

UTIITSL

portal:

https://www.utiitsl.com/

-

Click PAN card services: Select Apply PAN Card

-

Select Change/Correction in PAN Card: Click to apply

-

Click Apply for Change/Correction in PAN Card details

-

Choose Physical (forward the application with documents physically) if you prefer physically forwarding documents to their office

-

Choose Digital (Paperless) if you want to upload documents electronically

-

Enter your PAN

-

Choose a physical PAN Card and e-PAN if you want to have the corrected PAN card in digital and physical formats

-

Next, choose e-PAN only. No physical PAN Card will be dispatched if you want the corrected PAN card in electronic format

-

Click Submit

-

Fill in the PAN Change Request Form online

-

Select the checkbox next to the parameters you wish to change

-

For example, if you want to change how your name is spelt, enter the correct spelling, and select the checkbox on the left margin. Note: The changes will not be made if you do not select the checkbox. Check all your details and submit form

-

Once your changes have been verified, a 15-digit acknowledgement number will be shown on the screen. Make a note of this number. This number will be required for future follow-ups and to keep track of your application.

-

Make the payment, take a printout of the acknowledgement, attach the required documents, and send them to any one of the UTIITSL offices in Mumbai, Kolkata, New Delhi or Chennai.

The last step of submitting documents is not required if you have digitally uploaded the documents after signing and verification.

2. Through NSDL (National Securities Depository Limited)

-

Visit the

NSDL PAN application portal

-

Fill out the PAN change request form and submit it (Make sure that all the information entered is correct, or the form will fail to submit. In case of discrepancy, you will receive an error message to rectify)

-

Make the payment of ₹110 (inclusive of GST) to get the physical copy of your updated pan delivered to a domestic address

-

If your communication address is outside India, you must pay ₹1020 (inclusive of GST)

-

Once your application is submitted, you will receive a 15-digit acknowledgement number. You can use this number for tracking and further communication.

Are you making your PAN card correction online? Once you do it, update the same in your Federal Bank savings account linked to Fi. Keep your account updated for a swift and hassle-free financial journey with Fi Money .

How to Get Corrections Done on your PAN Card Offline

Your PAN Card details can also be changed offline.

- You must first download and print the PAN correction form.

- Fill up and submit the PAN correction form and self-attested copies of supporting documents at your nearest Protean eGov Technologies Limited or UTIITSL centre.

- While filling in the details in the form, remember to tick the box on the left margin for details that you would like to be changed on your PAN card.

Things to Remember for PAN Card Correction

Take care of the following while submitting the PAN card update form for corrections to be made to your PAN card:

- Individual persons should not use abbreviations in their first and last names.

- Non-individual legal entities like companies, partnerships or trusts should enter their full name as it is. For instance, if your company's name is 'ABC Computer Corporation Private Limited', fill up the complete name 'ABC Computer Corporation Private Limited' in the space that says last name/surname.

- If the space on the first row is insufficient, you can continue the corporation or individual's name in the second row.

- Make sure that there are no abbreviations in the company's name.

- For individuals, if your PAN Card has an incorrect or unclear photograph or signature that needs to be corrected, you must submit your original PAN Card when you submit your acknowledgement.

Documents Required, Fees & Status Check for PAN Card Correction

Documents Required for PAN Card Correction

For Indian Citizens & Hindu Undivided Family (HUF)

Supporting Documents for Changes to PAN

Processing Fees & Charges for PAN Card Correction

The fees charged for making corrections to your PAN are ₹85 + GST = ₹96.

Check PAN Card Correction Status

You can check the status of your PAN card correction application after applying. You can use the acknowledgement number. If you receive this number after the successful form submission, be sure to note it.

-

Go to the

UTIITSL

website at

https://www.utiitsl.com/

-

Click PAN Card Services: Click to visit

-

Click Track PAN Card: Click to track status

-

Enter your application coupon number, your PAN number (if required), and other details

-

Click 'Submit' to track the status of the change

Conclusion

It is commonly perceived that applications for changes to official government documents are tedious, cumbersome and time-consuming. You may have a similar perception about modifications to your PAN card details. Fortunately, applying for changes to your PAN card is simple if you know the procedure.

Frequently Asked Questions

1. What is the process for PAN card correction?

Once you log in to the NSDL PAN card correction portal, you can easily choose a PAN card correction application and fill out out. You'd also be charged a fee for the same, and you can opt-in for a payment mode that is convenient to you. After this, you will get your confirmation and can send in the required documents to the PAN authorities via post.

2. What documents are required for PAN card correction?

You would need documents that prove your identity, address, and age. Here's a list of documents you'll need: Identity proof (Aadhaar card, Elector’s photo identity card, Driving license, Passport, Ration card with photo, etc.), Address proof (Aadhaar Card, Elector’s photo identity card, Driving license, Passport, Spouse's passport, Post office passbook with the applicant's address, Latest property tax assessment order, etc.), and Age proof (Aadhaar card, Elector’s photo identity card, Driving license, Passport, Matriculation certificate or Mark sheet of recognised board, Birth certificate, etc.)

3. How to fill PAN card correction form online?

Here's how to complete PAN card correction online -

Through UTIITSL (UTI Infrastructure Technology And Services Limited)

-

Visit UTIITSL portal:

https://www.utiitsl.com/

-

Select PAN card services and click on "Apply PAN Card."

-

Choose "Change/Correction in PAN Card" and select either physical or digital application.

-

Enter your PAN and complete the PAN Change Request Form online.

-

Verify your details, submit the form, and note the 15-digit acknowledgement number.

-

Make the payment, print the acknowledgement, attach the required documents, and send them to UTIITSL offices.

Through NSDL (National Securities Depository Limited)

-

Visit the NSDL PAN application portal.

-

Fill out the PAN change request form accurately.

-

Make the payment of ₹110 (or ₹1020 for international addresses).

-

Receive a 15-digit acknowledgement number for tracking and communication purposes.

Note: Follow the specific portal instructions for a smooth application process.

4. How long will it take for PAN correction?

It usually takes 15-20 days for your updates or corrections to reflect on the PAN card and for you to receive it.