How do Credit Cards Work: A Beginner’s Guide

A credit card works by allowing you to borrow money from a financial institution (the issuer) up to a pre-approved limit. You can use this revolving credit line to make purchases and repay the balance within a 20–25 day grace period to avoid interest charges. If you miss the due date, interest is applied to your outstanding balance until it’s cleared.

If you’re beginning your journey to build better financial habits, understanding how credit cards work is essential. In India, the number of credit card users has been rising rapidly, with over 62 million active cards in FY 2020–21 alone.

So, what makes credit cards so popular? And should you consider getting one? This guide covers how credit cards work, what to keep in mind before applying, and how to use them wisely to build your credit health.

A credit card is a financial tool that lets you borrow money up to a pre-approved limit to pay for goods and services. When you make a purchase using a credit card, you’re essentially borrowing funds from the card issuer, usually a bank or financial institution. You’re then required to repay the borrowed amount within the due date to avoid any interest charges.

Credit cards are especially useful when you need flexibility. For example, when you want to make a purchase but prefer to pay later or spread payments over time.

Key Players Involved

Cardholder: The person authorised to use the credit card.

Card Issuer: The financial institution (like Federal Bank) that issues the card and sets the credit limit.

Merchant: The business or service provider that accepts credit card payments.

Payment Network: Platforms like Visa, Mastercard, or RuPay that facilitate secure payment processing between the issuer and the merchant.

Every credit card comes with a credit limit: the maximum amount you can borrow using that card.

The issuer decides your credit limit based on factors such as your income, age, credit score, and repayment history.

You can continue to make purchases until you reach this limit, and your available limit refreshes as you repay your dues.

Maintaining low credit utilisation (using less than 30–40% of your limit) helps build a strong credit score over time.

A credit card allows you to make purchases by borrowing money from a financial institution (the issuer) up to a set limit. The issuer pays the merchant on your behalf, and you repay the amount later — ideally within the grace period (20–25 days) — to avoid interest charges.

Let’s break down how it works:

A billing cycle is the period during which all your transactions are recorded, usually lasting 25 to 31 days.

At the end of the cycle, your card issuer calculates the total amount due, which appears on your monthly statement.

Example: If your billing cycle runs from 1st to 30th of a month and you spend ₹25,000 on the 10th, your payment due date might be around the 20th of the next month.

Your monthly statement summarises:

Paying the total amount due on or before the due date ensures you avoid interest charges. Missing it means interest will accrue on your outstanding balance (e.g., ₹25,000) until it’s fully repaid.

Example: If your credit limit is ₹1 lakh and you spend ₹25,000, you owe that amount to your issuer. Pay it in full by the due date, no interest applies. Miss it, and interest is charged on ₹25,000 until you clear your dues.

Below is the general information on eligibility and documentation for credit cards in India. These may change from bank to bank and provider to provider.

Please note: Specific document requirements and eligibility criteria can vary among banks and credit card types. Hence, checking with the bank you're interested in for precise details is essential.

The most common advantages of credit cards include:

1. Convenience: Credit cards offer a convenient way to make payments without carrying cash.

2. Build Credit: Responsible credit card use can help build a positive credit history, which is essential for loans and financial transactions.

3. Rewards and Cashback: Many credit cards offer rewards, cashback, or discounts on purchases, providing cost savings.

4. Security: Credit cards offer fraud protection, and liability for unauthorized charges is typically limited.

5. Interest-Free Period: Credit cards often provide an interest-free grace period for repaying purchases, usually around 20-50 days.

6. Emergency Funds: Credit cards can serve as a financial backup during emergencies or unexpected expenses.

7. Travel Benefits: Some credit cards offer travel perks, such as insurance, airport lounge access, and discounts.

8. Record Keeping: Credit card statements provide a detailed record of spending, aiding in budgeting and expense tracking.

Read more: MagniFi - The Ultimate Weekend Credit Card

Below are the different types of credit cards:

Let’s understand their features and benefits in detail:

Using a credit card could mean convenience but it also needs to be dealt with caution. Below are some of the best practices for managing credit card debt:

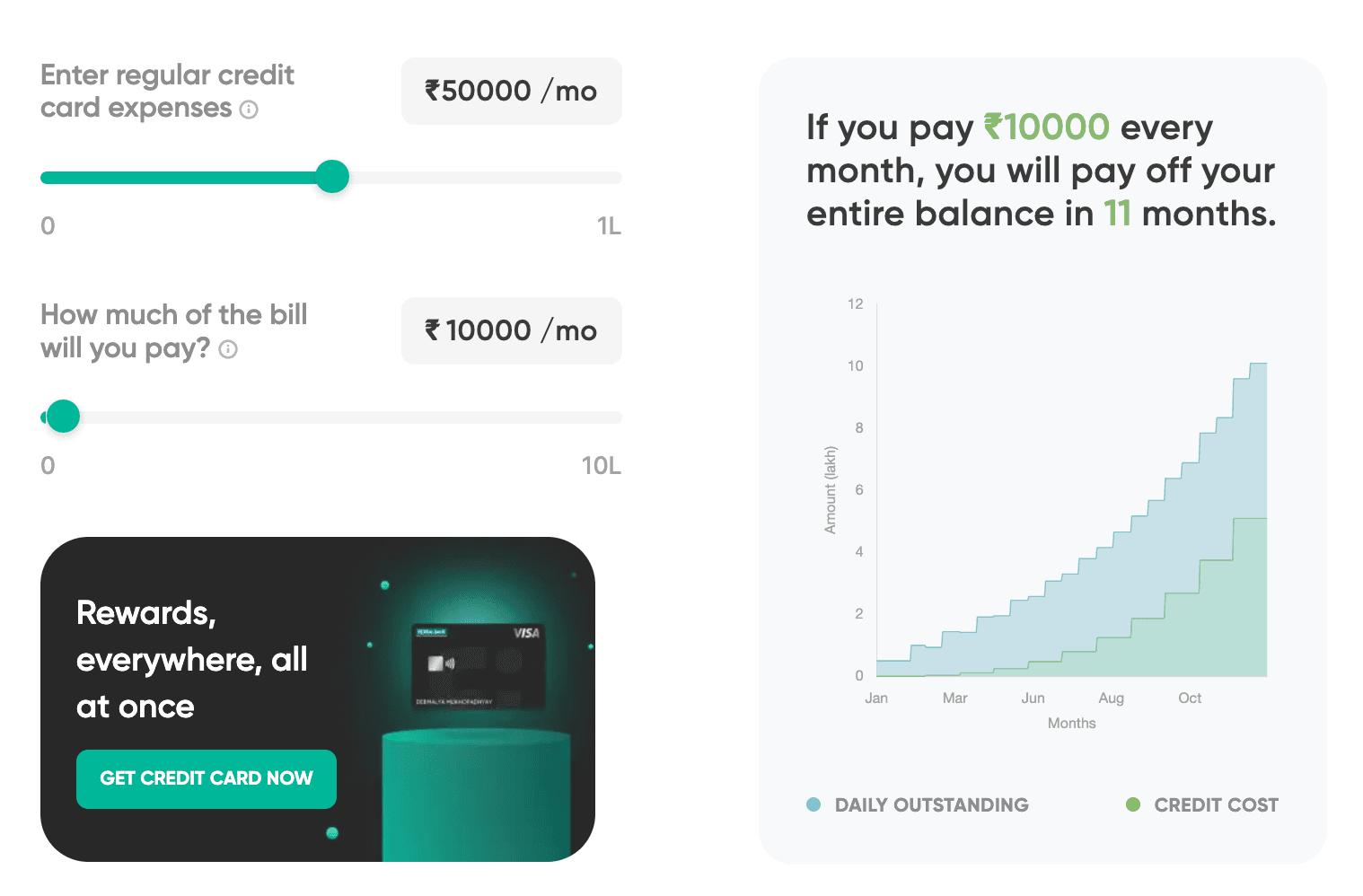

Fi's credit card interest rate calculator helps you calculate how much interest you will pay on your credit card balance over a certain period of time, if you don’t pay the whole amount. You can use this calculator to see what happens if you pay just the minimum amount or any other amount that’s lesser than the whole amount due.

Try it for yourself:

Let’s say you plan on buying an iPhone, but do not plan on paying the whole amount due on your credit card at the end of that month. And let’s say you continue using your card every month thereafter. This credit card interest rate calculator then tells you how much you’ll have to pay as interest at the end of a certain number of months, giving you a sense of your repayment duration.

Starting out with your first credit card? Here are a few smart habits to help you manage it wisely:

Start with a low-limit card:

Begin with a modest credit limit to build healthy spending and repayment habits.

Avoid impulse purchases:

Spend only what you can comfortably repay before the due date.

Understand your billing cycle:

Know your billing period and due dates to plan your payments effectively.

Set up auto-debit for payments:

Enable auto-pay to ensure timely bill payments and avoid late fees or interest.

Review your statements regularly:

Check your monthly statement for errors or unauthorized transactions to stay secure.

A credit card is one of the best payment methods that you can use. It allows you to purchase your favourite products and services and pay for them later. Additionally, you also get to enjoy several rewards and discounts for using your card And get to build credit history and increase your credit score.

A credit card allows you to pay for products and services even when you don’t possess the required funds. The amount of money that you spend on a credit card has to be repaid on or before the stipulated due date.

Also, paying for expensive products and services is more convenient with a credit card since you don’t have to carry large amounts of cash with you. Other uses of a credit card include the ability to avail loans against it, convert large purchases into more manageable instalments, and keep a track on your expenses.

To use a credit card online, all that you need to do is choose the ‘credit card’ option at the payment gateway, enter the details of the card, and proceed to make the payment.

To use it offline, simply insert the card into the card reader machine and enter your card’s four-digit PIN to make the payment.

Finance charges is the rate of interest that’s charged on cash withdrawals and unpaid outstanding dues on a credit card. It is often represented as a percentage per month or percentage per annum.

Credit cards are important tools in building a good credit history - this helps in loan approvals and getting better interest rates on it. Credit cards also offer convenience and flexibility for making purchases, especially online and while traveling. They also offer multiple discounts and rewards and can help in building a good financial plan.

To build and improve your credit score using a credit card:

When choosing a credit card, consider the interest rate, annual fees, rewards and benefits, credit limit, credit score requirements, and any additional terms and conditions that may impact your financial goals and spending habits.

If you're looking for a credit card that gives you the best bang for your buck, the Fi-Federal co-branded Credit Card is what you need. With this card, you're assured of a 2% valueback through rewards. But that's not all, as you'll also get 5x on your top 3 brands, 2x on all partner brands listed in the Fi Collection and 1x on everything else, including rent and fuel. What's unique is that you earn points through Fi-Coins. For travellers, the perks are even better, as you can convert your Fi-Coins to airline miles or cashback.

But that's just the tip of the iceberg: you'll also enjoy airport lounge access, 1% forex, the freedom to choose your billing cycle, and personalised reminders. With consolidated spend insights, you can easily track your spending and make informed financial decisions. Oh, and the welcome offer includes exclusive vouchers from top brands worth ₹5,000!