Beginners Guide To Travelling Abroad With Zero Forex Debit Cards

Planning a trip abroad is exciting. Months before the trip, your head gets wrapped up in visa requirements, affordable flights, and scenic accommodations.

Not to mention hours spent doing online research *cough* Instagram *cough* on things to see, eat, do, etc.

That's when it hits: You need foreign currency to do anything outside India.

This stuff boils down to Forex, i.e. Foreign Exchange, where you change Indian currency to a foreign currency for a Forex fee. But some quick Googling reveals there are Debit Cards that don't charge a Forex fee.

Lucky for you, the Fi app offers a free Zero Forex Debit Card issued by Federal Bank — for select account plans. We'll jump into this plan later. For now, let's go back to Zero Forex Debit Cards.

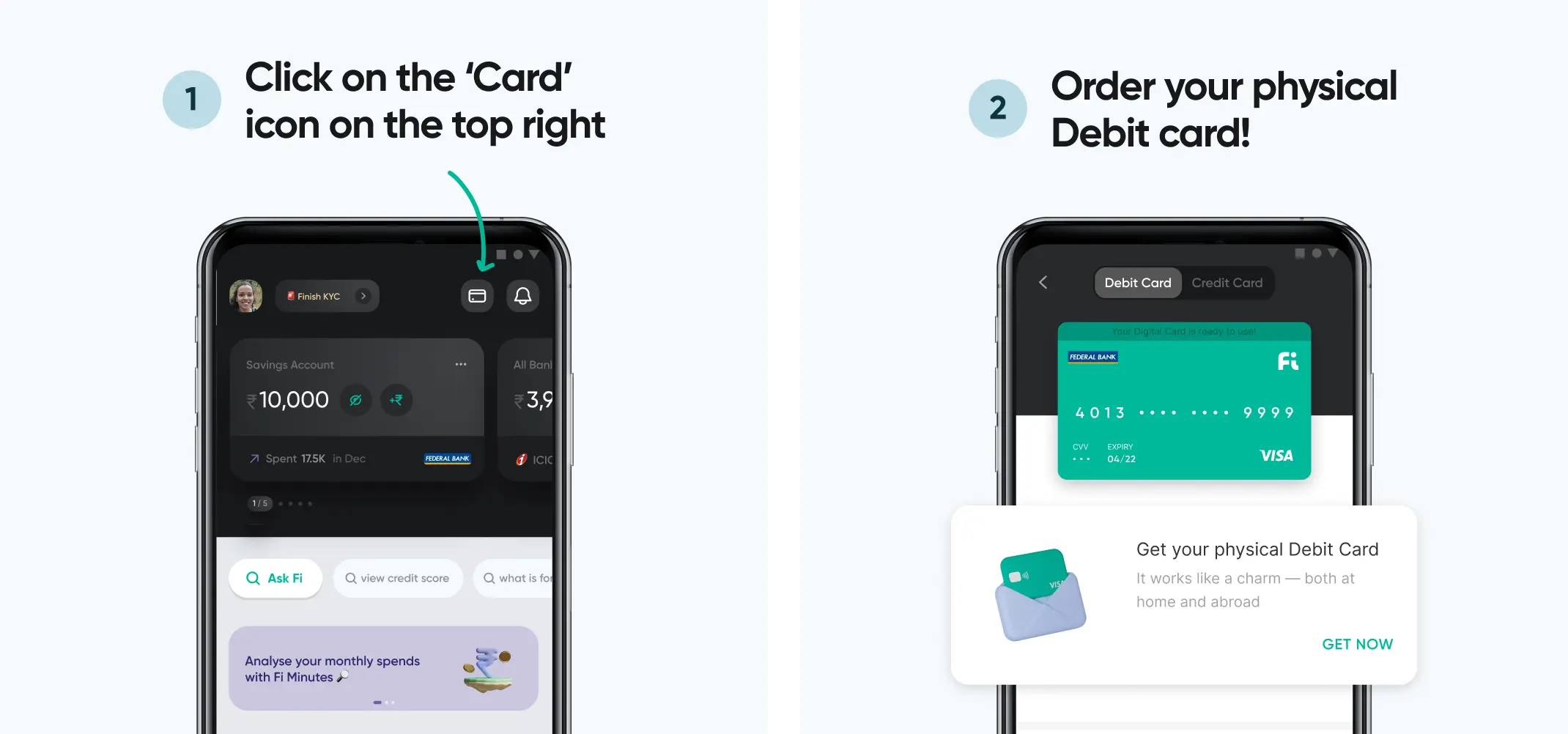

Already placed an order for a Debit Card? You can skip this section. If you haven’t, read on. Place an order through the Fi app, and your Zero Forex* Fi-Federal Debit Card will arrive in 7-10 days — quicker if you live in a metropolitan area.

Here's the short version:

Of course, as any seasoned traveller would recommend, it’s always a safe bet to carry a nominal amount in the local currency regardless of which country you travel to. (Maybe you’ll find a quirky ice cream stall that accepts only cash!)

It’s always best to be prepared. Now, that you got the gist — let’s get into the nitty-gritty of it all.

As soon as your Debit Card arrives, activate it.

Now, you are almost ready to take the card abroad. Check Step #2.

Fi-Federal Debit Card offers Zero Forex perk for select plans only.

To avail the unlimited forex fee option, users must upgrade account plans.

How? Add & maintain sufficient account balance per plan needs.

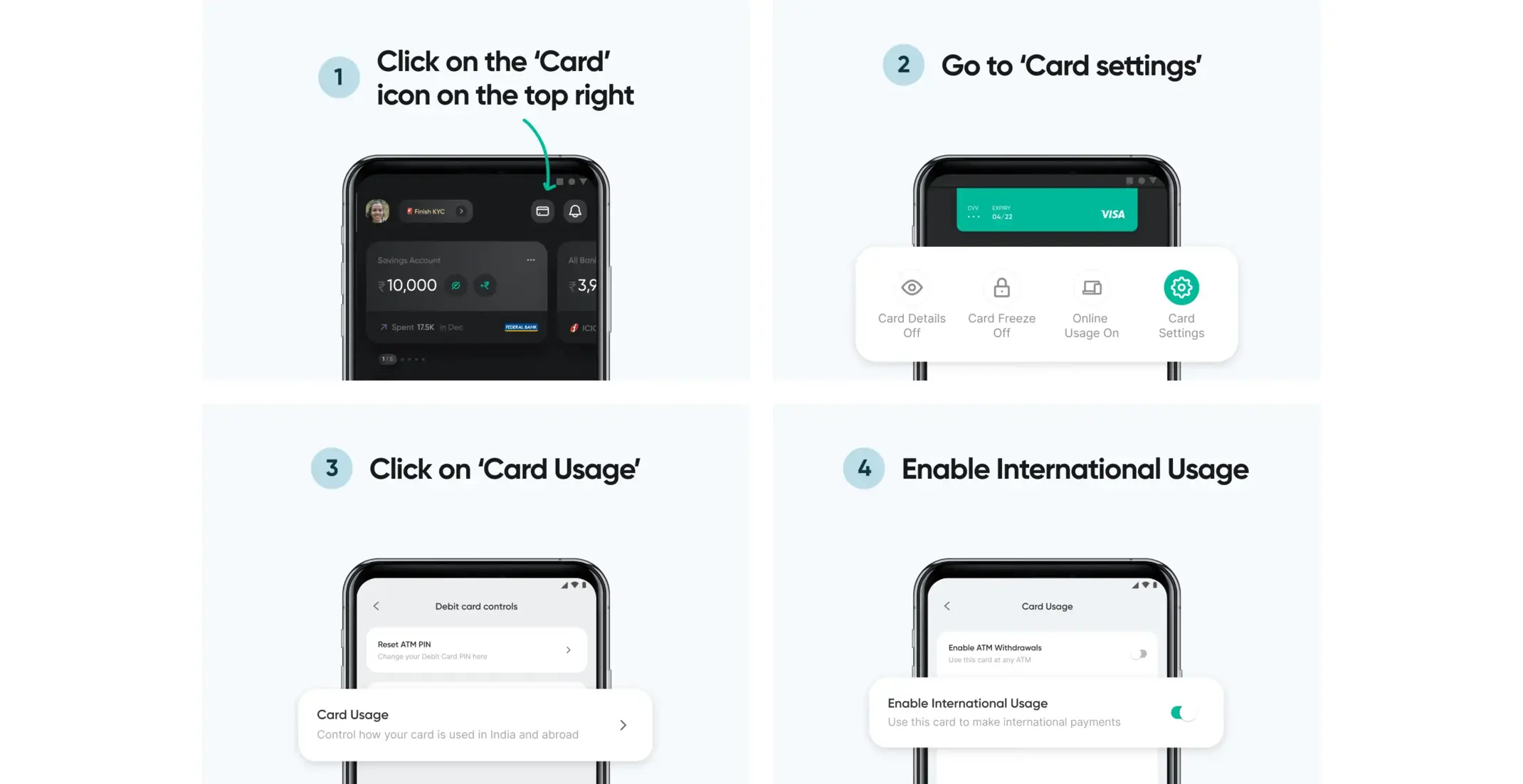

To use your Zero Forex* Fi-Federal Debit Card abroad, enable International Usage.

You'll need this to make payments with the card abroad.

Steps to enable International Usage for your Debit Card through the Fi app:

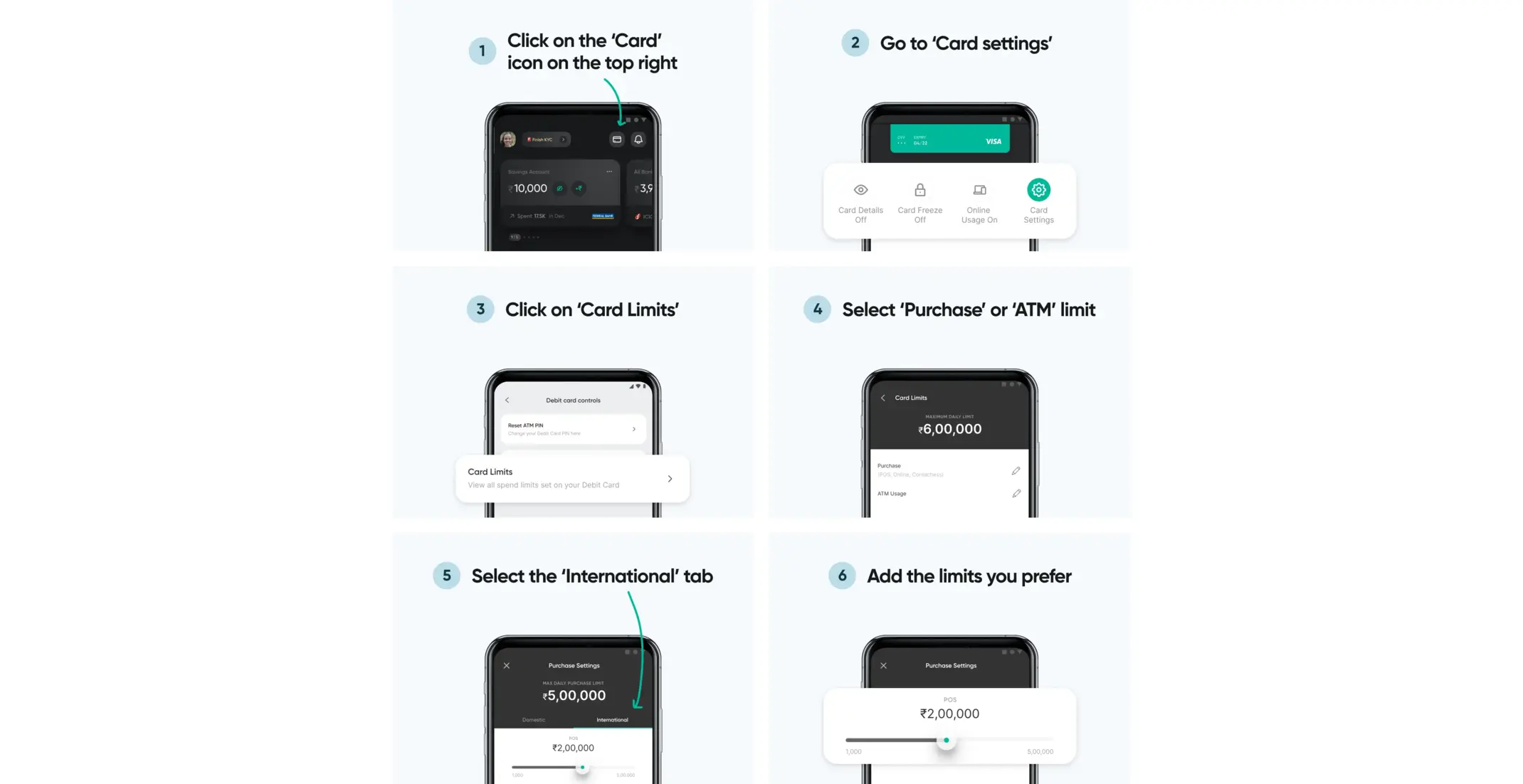

Setting limits on your Debit Card will help you keep tabs on your card spends:

Here, you can set your spending limits for online shopping, international ATM use, and swiping at a POS machine. You can also manage your contactless (Tap & Pay) spending.

Pro-Tip: Wondering how the Indian Rupee holds up abroad?

Use Visa's official currency converter calculator.

It also helps as the Fi-Federal Debit Card works on the Visa network.

After enabling International Usage, you have to set Card Limits.

You can use your Debit Card wherever VISA is accepted 💳

Remember to enable ATM usage & set the proper international limits.

There is a maximum per-day ATM withdrawal limit.

This limit varies on a country-to-country basis.

Check here for a complete list of ATM Withdrawal limits in countries.

Withdrawing cash from an International ATM? There's a fee: ₹200.

A Forex fee of 3.5% gets charged during the moment of purchase.

It applies for all international spends — regardless of account plans.

3.5%+GST of the international transaction amount is your forex markup.

Don’t worry; it will be reversed for eligible users within 30 days.

(Eligible implies folks who remain on or upgrade to better account plans.)

FYI: Forex charges will not be reversed on incoming transactions!

Card Replacements

Misplaced your Debit Card? Don’t worry.

Replacement card fees depend on your account plan.

Infinite/Prime: Get a replacement card for ₹199 + GST

Plus/Standard: Get a replacement card for ₹499 + GST

Crypto transactions

Crypto transactions will be charged a 3.5%+ GST markup — regardless of plans.

Card issuance & Annual maintenance

Salary/Infinite: Free Debit Card + No annual maintenance charges

Plus: ₹499+ GST + Annual maintenance charges: ₹199**

Standard: ₹499+ GST + Annual maintenance charges: ₹299

**These charges are waived for Plus users if their Debit Card spends are more than ₹25,000. This applies only if the spends occur within the last 12 months from the card's anniversary date.

Purchase transaction decline fee (due to insufficient funds)

We’ll waive the fees on the first 2 transaction declines in a month.

3rd international transaction decline onwards: ₹100 per decline.

So, please make sure you have enough try funds before you withdraw.

Once you’ve understood the fees and completed all the steps involved above, you’re all set for the Zero Forex advantage of the Fi-Federal Debit Card.

Bon voyage 🛫

*Note: All mentions of zero forex in this blog refers to Zero Forex available only on select plans for now to users.