20 Side Income Ideas in India to Earn Extra Money with a Full-Time Job

Inflation in India was 4.7% in April 2023, according to the Consumer Price Index (CPI). However, this only takes into account a limited number of goods and services and does not reflect all the expenses people have. For example, rents in urban areas are increasing rapidly. If your current source of income is not likely to keep up with this inflation, you should consider other sources of income.

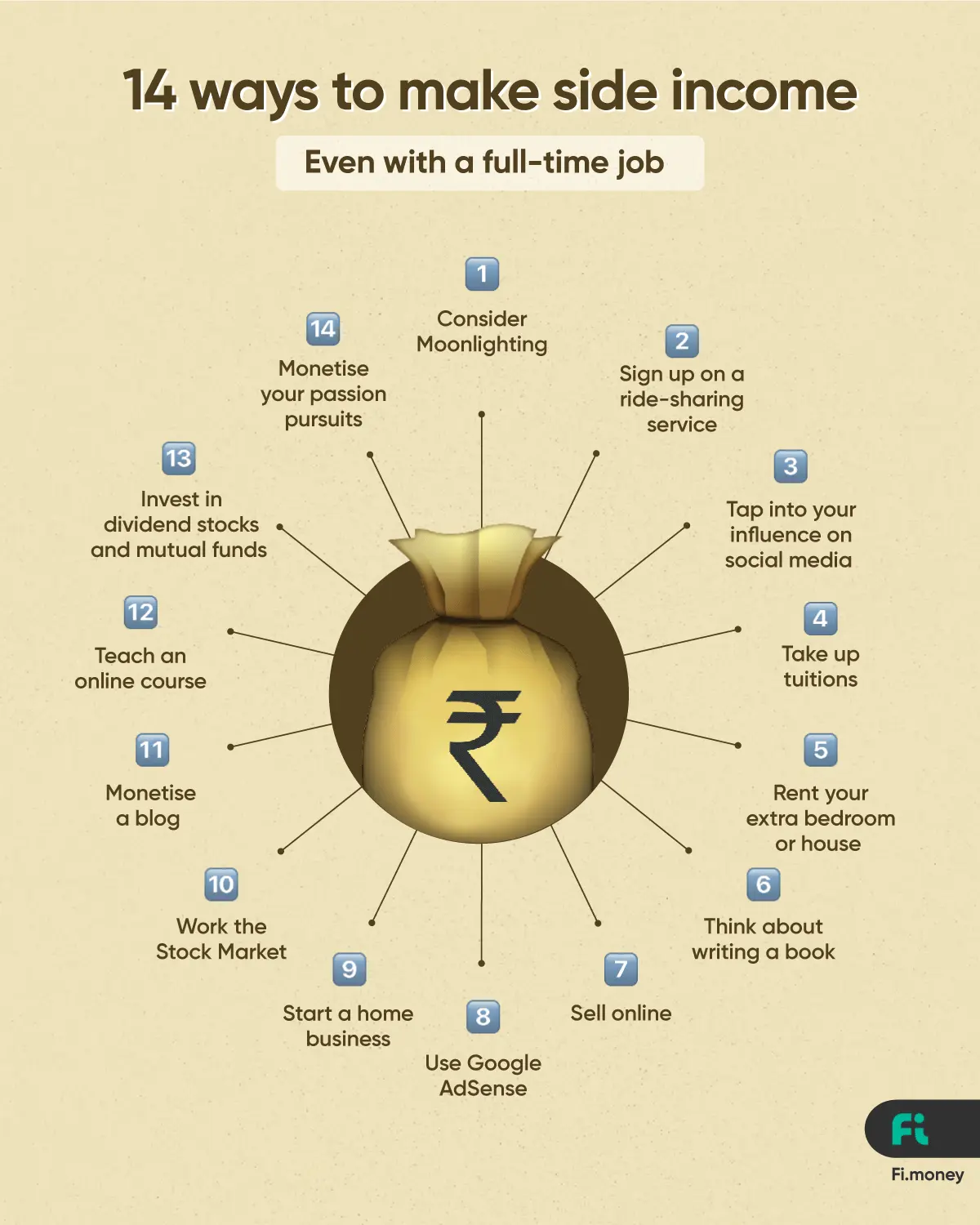

In this article, we will discuss 20 side income ideas and sources to earn extra money with examples.

Passive income is money earned without actively working. Generally speaking, it leverages existing skills and requires minimal investment. It offers financial freedom and flexibility, supplementing or replacing regular income.

Research and choose the right opportunity. It takes time and effort but can be rewarding financially and personally.

Working a side gig or extra job while keeping your regular employment, gained attention last year with CEOs taking sides for or against it. While it can be a great way to earn more money or pursue passions, it's important to ensure it doesn't clash with your main job or violate any agreements. Check your company's official stance on secondary source of income before starting.

Some examples could be:

If you commute every day, you can earn extra money by picking up passengers on your route with ride-sharing. Apps like Quick Ride generally manage these services. However, if you're a woman, you may want to consider alternative options for earning extra income due to safety concerns. Being alone in a car with a stranger can be risky, so keep personal safety in mind.

To start a home business, consider organic farming, catering, making handmade products, or freelance writing. Choose something you enjoy and are good at, and can do from home. It may take effort to get started, but with dedication, a home business can provide passive income.

Offering tuition in India is a good way to earn extra money. You can teach subjects such as English, Math, Science, or the Arts. You can also become a certified instructor in Yoga, fitness, or swimming. This can lead to a career in those areas. Teaching allows you to share your knowledge and passion while earning extra income.

If you have extra space that you aren't using, renting it out on Airbnb can be a popular way to supplement your income. It's important to note that this only works if you have your property or if your landlord allows you to sublet their space.

Writing a book can be life-changing! You can share your wisdom and experiences with a wider audience, boost your credibility and expertise, and open doors to exciting opportunities and collaborations. Plus, book sales and royalties can provide passive income for years to come.

Selling online is another option if you have access to inventory. You can do it through platforms like Amazon, Flipkart, or Meesho - they make it super easy to list your products and manage everything from payments to shipping.

Google AdSense is a free program that pays you for displaying ads on your website or blog, or YouTube channel. You earn a commission when someone clicks on an ad. The amount you earn varies depending on the ad type, clicks, and visitor location. To use AdSense, create an account and add the code to your website. You can control the ads that appear and hide them on certain pages. However, AdSense works best when you have an established website or blog, which takes 1-2 years to grow.

To become an influencer or content creator, choose your niche and create awesome content consistently. Engage with your audience, collaborate with other influencers, promote your content across platforms, and use relevant hashtags to reach more people. This is easier said than done, but if you enjoy creating unique, original content, then this is an option worth considering.

Now, read this one with a pinch of salt. Trading on the stock market is a popular side income idea. To start, educate yourself by studying the basics of investing through books, videos, and reliable financial news sources. Learn key terms and concepts, such as stocks, bonds, and diversification. Once you feel comfortable, open a brokerage account to buy and sell stocks. Start with small investments and gradually increase your portfolio. Stay informed, do your research, and be prepared for market fluctuations as investing carries risks.

Once you’re ready, leverage investing in top US companies through Fi Money with industry-best forex rates, zero brokerage fees, and a user-friendly interface.

To create a successful blog that earns revenue from site traffic, follow these steps: Choose a topic you enjoy, research popular keywords, and create high-quality content. Optimise your blog with the right titles, headings, etc. Promote your blog on social media and interact with your audience. Keep an eye on your SEO strategy, adjust as needed, and watch your blog grow while you earn money.

Here are some ideas for blogs across different interest areas to get you started:

Don't be overwhelmed by the work ahead. Use AI tools such as ChatGPT or Google Bard for support with topic ideas and coding. Keep the content original and useful.

Platforms like Udemy, Coursera, and Skillshare offer masterclasses on a variety of topics, from legal advice and coding to analytics, copywriting, and graphic design. Professionals can create online courses and earn passive income by sharing their expertise. Consider giving it a try if you have specialised skills to share and want to make money while helping others improve.

Dividend-yielding stocks and mutual funds can earn you money through regular dividend payments. Companies distribute a portion of their profits to shareholders as dividends, and mutual funds pass on the dividends earned by the securities they hold. You can receive dividends as cash or reinvest them to buy more shares, but keep in mind that dividends are not guaranteed and can vary. Choose your investments wisely based on your goals and risk tolerance.

Check out this list of 10 Highest Dividend Paying Stocks in India.

You could make music and share it on platforms like Spotify or YouTube. Alternatively, you could create simple apps like a habit tracker or a ChatGPT-based text editing tool. These apps could have a free version with ads or a paid subscription option.

Have you ever told a friend about a great product, and they bought it? Imagine if you got paid every time that happened! That's exactly how affiliate marketing works. You sign up for affiliate programs, share product links, and earn commissions when someone purchases through your link. It's one of the most popular secondary sources of income because you don't need to create a product. You just need to talk about things you already love!

If you have some extra cash, you can start Peer-to-peer (P2P) lending. Many platforms like Faircent, Lendbox, IndiaP2P, etc., allow you to lend money to your other individuals or small businesses and earn interest on your loans. It's a smart way to create a passive income stream while helping others get the needed funding.

Just be sure to spread out your investments across multiple borrowers to reduce risk.

Yes, you can earn extra income by sharing your opinions. There are many survey platforms that make it easy to cash in. You won't get rich overnight, but answering surveys while watching Netflix and earning extra money is not so bad. You can sign up for multiple survey sites to increase your earnings. Some even offer gift cards and bonuses!

Did you know that domains are like virtual real estate? If you have an eye for catchy names, you can buy domain names at a low price and sell them for a profit. Brands and businesses are always looking for the perfect domain; some have sold for thousands (even millions) of dollars!

Start by grabbing unique or trending names at low prices and listing them on domain marketplaces. You might own the next million-dollar web address if you're lucky!

Do you know how to design cool graphics, t-shirts, or phone cases? You don't need a store to sell them! Platforms like ShopClues, eBay India, Meesho, Amazon, etc., let you upload your designs, and they take care of printing and shipping. Every sale earns you a commission.

This is a great secondary source of income for artists, designers, or even meme enthusiasts.

Suppose you have a car that spends more time parked in the garage. In that case, you can rent it out and earn extra money. Platforms like Zoomcar, Myles Cars, etc., let you list your vehicle for others to rent, which earns you some additional income. Please ensure you have the right insurance coverage and set competitive pricing.

We've a few good tips for you to manage your income and finances when you have multiple streams of income.

Many of the tips in this article are easier said than done and take years to cultivate and grow to a point of success where you can earn money from them. However, passive income is meant to supplement your main income. If you sow the seeds early on, you can have enough passive income to cover you later in life. This blog was meant to provide you with an overview of various side income ideas and sources and is not intended to be taken as a professional career or financial advice. Enjoy what you do, and the money should flow in over time.

Users can find several investment options through the Fi Money app. Be it short-term or long-term, it's easy to invest in US Stocks or Mutual Funds with a simple swipe of your phone's screen. But if you want to save up for a short-term goal & earn interest on it, select our super-flexible Smart Deposit. If you're looking for higher/stable returns, opt for a Fixed Deposit.

One of the best sources of income in India is rental property. However this can depend on the city, the location of the property, and the size and amenities associated with the property.

Some of the most profitable streams of passive income include rental income, trades made on the stock market, being an influencer on social media, and using Google AdSense.

Some popular side income sources in India include:

These are flexible, scalable, and fit various skill levels.

To earn extra income from home while working full-time, choose options that offer flexibility and remote access, such as:

Pick something that fits your time and energy after work hours.

The easiest way depends on your skills and available time. However, low-barrier options include:

Start small and test what works best for you—"easy" doesn't mean instant.

Yes, side income is taxable in India. It should be added under "Income from Other Sources" or "Profits and Gains from Business/Profession" while filing your ITR.

We recommend consulting a tax advisor to stay compliant and plan deductions smartly.

You can start with 5–10 hours a week.The key is consistency, not volume. Even a few hours after work or on weekends can build up a meaningful income stream.

Yes, for many people, it can eventually happen. But it takes time, effort, and a clear plan. Before making a switch, focus first on building a steady second income, validating your idea, and scaling gradually.

Active side income requires time and effort—like freelancing, coaching, or deliveries. Passive side income earns for you with minimal effort after setup—like rental income, blogging, or stock dividends. Most start with active sources and build passive ones over time.

Yes, many online earning sources are legitimate, like Upwork, Fiverr, Amazon Seller, UrbanPro, etc. To avoid scams:

High-demand skills for freelancing in India include:

Learning platforms like Coursera or YouTube can help you upskill quickly.

Start with one solid income stream, build confidence, and then diversify.

For example: